By Moses Leos III

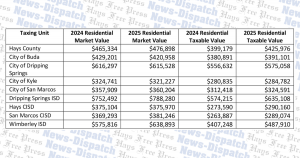

An incentive agreement approved by Kyle city leaders earlier this month aims to rectify an error that led officials to not bill a company for roughly $430,000 in property taxes over a six-year period.

The Kyle City Council approved an agreement between the city and RSI, Inc. by a 5-1 vote. Council member Daphne Tenorio voted against the measure.

The city’s agreement calls for RSI, which is a military-based contractor, to incrementally pay back real property taxes that both the city and the county didn’t bill the company for between 2011 and 2016.

Kyle City Manager Scott Sellers said the issue began in 2011 when the city transferred the property to RSI on which the company had built its offices.

At that time, RSI’s certified public accountant reached out to local taxing entities regarding real properties and taxation, but city and county officials said RSI had “no tax obligation on real property” due, Sellers said.

RSI made calls to the city and county in subsequent years, with the county and city telling them they didn’t owe property taxes, Sellers said.

In 2016, the city discovered RSI should have been paying taxes all along.

Kyle Mayor Todd Webster said several factors led to the error, including the transition in city administrations over the years. But he said it was not entirely clear how such “a big mistake occurred.”

“There’s not a lot of benefit to assigning blame,” Webster said. “My sense of this is the city shares blame for this mistake, also the Hays Central Appraisal District (CAD) and some responsibility from the business owner.”

Sellers said the city reached out to the Greater San Marcos Partnership, along with Hays County, during the past calendar year to find a solution. He said they came up with a job creation and retention incentive for the company.

As part of the agreement, RSI would be required to pay upfront its total tax obligation of roughly $430,000. Webster said the company could potentially take out a loan to cover that cost. RSI would also be required to create 82 new jobs on top of the 50 it had to create as part of the original 2007 agreement.

In return, the city would cover roughly half of the amount in the form of a zero-interest loan. RSI would begin paying on the loan starting in 2018.

The city would then credit $1,500 per job created, up to 82 jobs, over a ten-year period. Hays County would match that amount, Webster said.

Council member Daphne Tenorio, however, said the agreement didn’t “sit well” with her. She said the city wouldn’t offer a zero-percent interest loan to citizens if they weren’t able to pay on their taxes. She said the city doesn’t offer a similar program to small businesses.

Tenorio believed the agreement placed the burden on taxpayers and that it sets the precedent for other business to potentially ask for similar agreements.

“This is a double-dipping into the incentive pools to me,” Tenoirio said. “It all falls down to not paying your taxes. Part of being a business owner is being a responsible business owner and knowing what you owe.”

Council member Travis Mitchell said he shared Tenorio’s sentiment and frustrations. However, he said RSI had records of trying to pay back taxes, but was told no by taxing officials.

He said it was an “incredibly difficult” decision, but that culpability lies with the business owner, along with the city and the county “for making the error in the first place.”

“We are culpable to get them over the hump,” Mitchell said. “We have to take responsibility for this.”